If you are a parent, your mission is clear: develop into a rich Bank of Mom & Dad to save your children. If you don’t have wealthy parents yourself, then unfortunately, life might stay on hard mode forever. It’s up to you to break the cycle for your next generation.

Ever since I started working on Wall Street in 1999, I’ve seen wealthy parents buy their children everything—from condos to cars to groceries. I saw this firsthand with my peers at Goldman Sachs.

While I was sharing a studio apartment with a high school friend and later a co-worker, some of my peers were getting $500,000–$750,000 condos from their parents. Instead of wearing ill-fitting suits from Century 21 like I did, they had tailor-made Armani. I was impressed… and a little jealous.

But more than anything, I was motivated. Working in Manhattan opened my eyes to what generational wealth can do. And now, as a parent myself, I see even more clearly how important it is to become wealthy—not just for my own peace of mind, but for my children’s future opportunities.

In my post, Income And Net Worth Required To Purchase A $10 Million House, one reader commented:

“The Bank of Mom and Dad phenomenon is so frustrating for those of us who have mostly earned everything… The few I know who ended up in a $10 million house in this situation still work pretty regular jobs… and they’ve traded up over the years. So I guess they get a little credit for making the best of their very nice birthright.”

It can feel annoying when your friends or peers are wealthier simply because of who their parents are. Even more irksome is how shameless many adult children seem about accepting help. There’s rarely any embarrassment. Nobody hides the fact they live in a $5-$10 million home bought by mom and dad, instead they throw parties and flaunt it on social media.

Only Three Ways to Stop Parents From Paying for Their Adult Children

One way to end the rich Bank of Mom and Dad phenomenon is for adult children to start refusing help and insist on making it on their own. But let’s be honest—that’s not going to happen. If free money is available, most people will take it. As a result, the trend will likely continue—and even accelerate—as more wealth is passed down.

Another way is for parents to start saying “no” to financial requests or stop offering help altogether. But when you have more money than you can spend in a lifetime thanks to investing for decades in the greatest bull market, that’s unlikely too. Love, guilt, and the desire to leave a legacy often outweigh ideals about financial independence.

The final—and most unrealistic—way to stop the trend is for sellers to reject money from parents. Imagine requiring every buyer to swear under oath that they earned the money themselves—like checking ID before selling alcohol. Sounds absurd, right?

Because let’s face it: if you own a BMW dealership and a 28-year-old’s parents want to drop $100,000 on a luxury SUV, are you really going to say no? Of course not. Money is money. And trying to screen buyers based on where their funds come from could open the door to legal trouble.

I Sold My Home to the Bank of Mom & Dad—And Liked It

As a home seller, my goal was simple: get the highest price and ensure the smoothest transaction possible. I didn’t care if the money came from the Bank of Mom & Dad, as long as it was legitimate. If the parents offered $50,000 more than another without parental help—everything else being equal—I was going with the higher offer.

Taking less would have been irrational. That $50,000 matters to me as a parent working to become a rich Bank of Mom & Dad myself. Every dollar helps secure my own children’s future.

My buyers were a couple in their early 30s and worked in big tech, likely making $500,000 to $800,000 total a year. But what sealed the deal was their 100% down payment—courtesy of one of their dads, who was willing to pay all-cash. He sent a letter from his bank verifying he had at least X million in funds.

As part of their preemptive offer, the buyers waived all contingencies (financing, inspection, insurance, etc.) and agreed to a 10-day close. In the end, the transaction took 13 days because the escrow company needed extra time to verify the cash source. Still, it was the easiest real estate deal I’ve ever done.

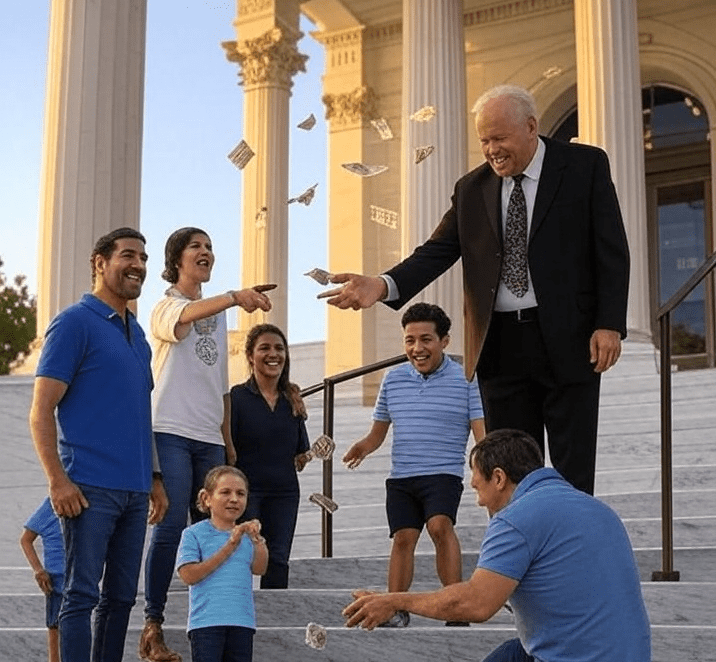

So thank you, rich mom and dad! You crushed it—saving and building wealth to support your son, daughter-in-law, and grandchild. And in the process, you helped me and my family simplify life and get liquid again. Respect.

How to Compete in a World Fueled by the Bank of Mom & Dad

Imagine not making $500,000+ working in tech. How are you going to afford a $1.8 million median home in the San Francisco Bay Area without help? You’re not.

The reality is, you’re not just competing against dual-income households making half a million dollars or more a year. You’re also up against their parents—wealthy, generous, and ready to help with down payments or all-cash offers.

And if that’s not enough, you’re also competing against international money. In global cities like San Francisco and New York, real estate also faces an international demand curve. My buyer’s dad wired money from Asia to close the deal.

If you didn’t grow up with wealth, you’ll have to play the game differently. Yes, the rules may seem unfair, but that doesn’t mean you can’t compete and win. Here’s how:

1. Accept the Game, Don’t Hate the Players

It’s easy to feel resentful when others get a massive head start. But resentment is wasted energy. Use it as fuel to work smarter, save more aggressively, and build wealth on your own terms. Use my psychological trick and tell yourself, “Everybody is richer than me, why not me too?”

Life isn’t fair and the sooner you accept this reality, the better. I could have spent my time complaining about how much harder life can be as a minority navigating a country filled with implicit biases. Instead, I chose to work as hard as possible to achieve financial independence sooner, so I could live life on my own terms.

2. Invest In Yourself Relentlessly

Education, skills, and social capital are your tools. Beware of competing with the person who continuously self-educates. Subscribe to the free Financial Samurai weekly newsletter. Purchase a copy of my USA TODAY bestseller, Millionaire Milestones. The amount of inexpensive educational resources out there are endless. Please take advantage.

The wealthy may have capital, but you can close the gap with hustle, adaptability, and strategic thinking. Many children from wealthy families squander their advantages because they take their good fortune for granted. View these lapses in judgment as your opportunity to get ahead. Network, negotiate, and never stop learning.

3. Use Other People’s Money Smartly

If you didn’t inherit money, learn to use leverage wisely. Real estate is one of the few asset classes where everyday people can build wealth using other people’s money—namely, the bank’s. It’s my favorite wealth-building vehicle for the average person because of its forced savings component, relative stability, income potential, tax advantages, and long-term capital appreciation.

At the same time, stay consistent with investing whatever you can into the S&P 500 with each paycheck or financial windfall. Over the long run, it’s tough to beat the simplicity and returns of the overall stock market. Just make sure you don’t get shaken out by market volatility. Instead, build the discipline to buy the dips and stay the course.

Investing aggressively over the long run is one of the best ways to build generational wealth.

4. Avoid Lifestyle Creep

Your peers may drive nicer cars or live in nicer homes thanks to their parents, but don’t fall into the trap of trying to keep up. You don’t have wealthy parents, so you cannot afford to act like them. Stay in your lane!

Save and invest the difference. Compound interest will be your ally while their spending habits become liabilities. Take satisfaction knowing you are living according to your values and within your means. Nothing can take away the honor of earning what you deserve.

5. Start Building Your Own Bank Of Mom & Dad Today

Whether you have kids now or plan to, think long-term. Build a portfolio of assets that generate passive income. Open custodial accounts and Roth IRAs for them. Teach your kids about money and how to work hard for it. Help them graduate debt-free and buy their first homes.

Break free from the cycle of only thinking about your own financial well-being. Start thinking in terms of generational wealth. The goal is to be in a position to help your family if and when they need it.

Ironically, if you can make your kids millionaires by their 20s, you may not need to help them much at all. When they are set for life, observe how your anxiety fades away.

Banks of Mom & Dad Are Only Going to Grow Bigger

You may not be able to stop the Bank of Mom & Dad from growing, but you can become a great bank for your own children. And once you do, you’ll realize that helping your kids doesn’t mean spoiling them. It means giving them a fair shot on an increasingly uneven playing field.

Accept that:

- Parents will never stop loving—and wanting to help—their children.

- Adult children will rationally swallow their pride and accept help from their parents.

- Asset owners will always sell to the highest, most reliable bidder.

The Bank of Mom & Dad isn’t going away. Accept its rise and adapt accordingly. Your family’s future depends on it.

Readers, how have you seen the Bank of Mom and Dad affect you and your children? Do you think there’s any way parents will stop financially helping their adult children, or that adult children will stop accepting money from their parents? Can we blame our parents for not saving and investing consistently during the greatest bull market of our lifetimes? What are you doing to ensure your children get a fair chance to compete?

Invest in AI for Your Family’s Future

One of my biggest concerns is that AI might eliminate millions of jobs—including the ones my kids and your kids may one day pursue. To hedge against this risk, I’m actively investing in AI-focused companies, both public and private.

That’s why I like Fundrise Venture—an open-ended venture capital product with exposure to leading AI companies such as OpenAI, Anthropic, Anduril, Canva, and more. Around 75% of the fund is allocated to artificial intelligence, and you can start investing with just $10.

Most VC funds require $100,000+ and an introduction to join. Fundrise Venture gives you access to the future—without the gatekeeping.

Fundrise is a sponsor of Financial Samurai, and I’m an investor in Fundrise. Check it out and position yourself—and your kids—for what’s ahead.